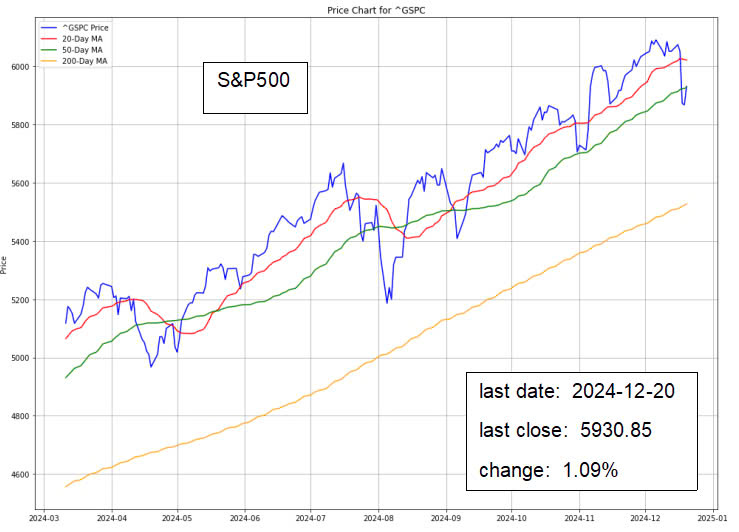

On Friday, U.S. stocks rebounded as investors reacted to key inflation data that showed a slowdown in price increases for November. However, these gains couldn’t offset earlier losses in the week. The Nasdaq dropped 1.8% for the week, and both the Dow and S&P 500 declined by approximately 2%.

Source: Nasdaq

In recent weeks, the U.S. stock market has experienced notable volatility, influenced by inflation data and Federal Reserve projections. The latest Personal Consumption Expenditure (PCE) report showed inflation at 2.4% in November, slightly below the expected 2.5%. As a result, stocks rebounded, easing concerns over aggressive rate hikes. Resilient consumer spending further underscored the economy’s strength despite ongoing inflationary pressures.

However, even with positive inflation data, the markets closed the week in decline. The Federal Reserve’s third interest rate cut in 2024, coupled with signals of fewer cuts in 2025, sparked mixed market reactions. Investors are now recalibrating their expectations, with some predicting the first rate cut of 2025 might come as early as March. Still, the Fed’s forecast of only two 25-basis point cuts next year—down from an earlier expectation of four—has fueled caution among market participants.

U.S. Housing Market's Surprising Resilience Sparks Hope for 2025

The U.S. housing market showed unexpected resilience in November, recording the biggest annual gain in home sales since 2021. This uptick was driven by an increase in housing inventory and a brief reduction in mortgage rates, which allowed more potential buyers to enter the market. The increase in home sales by 6.1% year-over-year marked a rare bright spot in a housing market that has generally been subdued over the past few years. However, this surge in sales could be short-lived. Mortgage rates, which had briefly dropped in the fall, have now risen again, leading to concerns that affordability issues will persist and cause sales to decline in the coming months. Many would-be buyers remain sidelined due to high mortgage rates, which continue to impact overall home-buying activity.

Source: Market Watch

Although the rise in inventory and the subsequent sales increase offer hope for 2025, the housing market’s future depends heavily on the trajectory of interest rates. The Federal Reserve’s actions in 2025 will play a crucial role in shaping the market’s recovery, with many economists predicting that a reduction in rates could improve affordability for buyers and revitalize the market.

US Farming Faces Declining Incomes and Growing Trade Challenges

Another sector feeling the weight of both domestic and international challenges is agriculture. The U.S. farming industry is experiencing a recession, driven by a combination of falling crop prices, rising input costs, and global trade uncertainties. The decline in net farm income by 4% in 2024, following a 20% drop in 2023, reflects the ongoing pressures faced by farmers, particularly those reliant on grain production. U.S. farmers are grappling with higher prices for essentials such as fertilizer and machinery, while weakened commodity prices for crops like soybeans and wheat have reduced their profit margins. Additionally, the recent federal spending bill includes a multibillion-dollar bailout for farmers, aimed at alleviating some of these financial strains.

Source: American Farm Bureau Federation

The agricultural recession has prompted both direct federal aid and policy discussions on trade, with concerns over the impact of tariffs on U.S. exports, particularly to China and Mexico. In response, some agricultural groups are lobbying for measures to support U.S. farmers, such as restrictions on used cooking oil imports from China and the expanded use of U.S.-produced soybean oil in biofuels. These measures aim to cushion the blow of lower commodity prices and maintain stability in the U.S. agricultural economy, which remains a key pillar of rural America.

GLOBAL IMPACT

US-China Chip War Heats Up as Legacy Semiconductor Battle Escalates

The ongoing “chip war” with China stands as one of the most prominent international issues affecting the U.S. economy. The U.S. leads in producing cutting-edge semiconductor technology, but China is rapidly closing the gap, especially in manufacturing legacy chips. These legacy chips, which face fewer restrictions than advanced chips, are crucial for industries like automobiles, household appliances, and basic electronics. These sectors play a vital role in global supply chains.

Source: Asia Times

China’s Semiconductor Manufacturing International Corporation (SMIC) has aggressively increased its capital investments, spending $41 billion on wafer fabrication equipment in 2024, up 29% from the previous year. This investment shift targets the rising demand for lower-end chips, used in industries like automotive production, which have faced supply disruptions recently. As global demand for these chips grows, Chinese manufacturers are capturing more market share, posing challenges for U.S. companies like Texas Instruments and GlobalFoundries, who dominate this market. While the U.S. still leads in producing cutting-edge semiconductors, the growing competition in legacy chips marks a significant shift in the global chip industry.

WATCHOUT

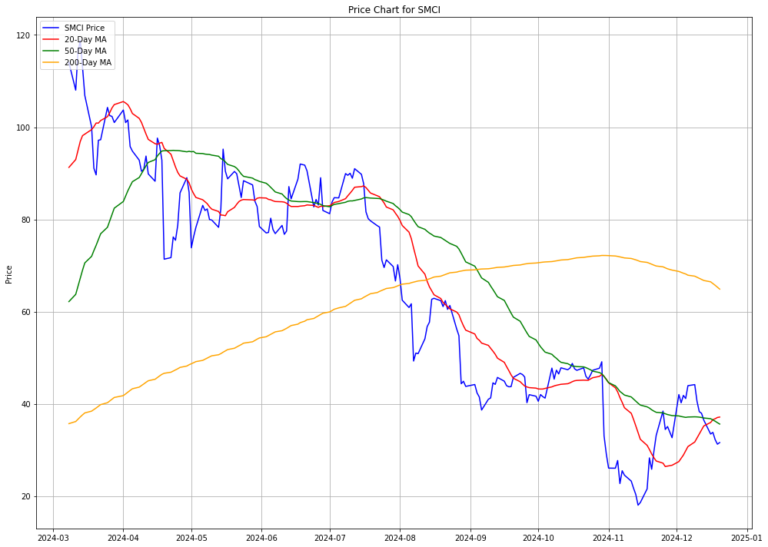

Super Micro Stock Volatile Amid Accounting Issues and Nasdaq Delisting Risk

Super Micro Computer‘s stock has faced significant volatility this year, ranging from $18 to $119, and has recently dropped 14%. Despite some recent market recovery, the company’s main hurdle for a full rebound lies in resolving its ongoing accounting issues, which could potentially lead to a delisting from Nasdaq if not addressed. The company missed its annual filing deadline and has been given until February 25 to report earnings. This delay follows the resignation of its former auditor, Ernst & Young, in October due to concerns over financial reporting controls. Although no fraud was found, Super Micro’s new auditor, BDO, and a search for new top financial officers highlight the uncertainties that continue to weigh on the stock.

Investment Opportunity & Risk

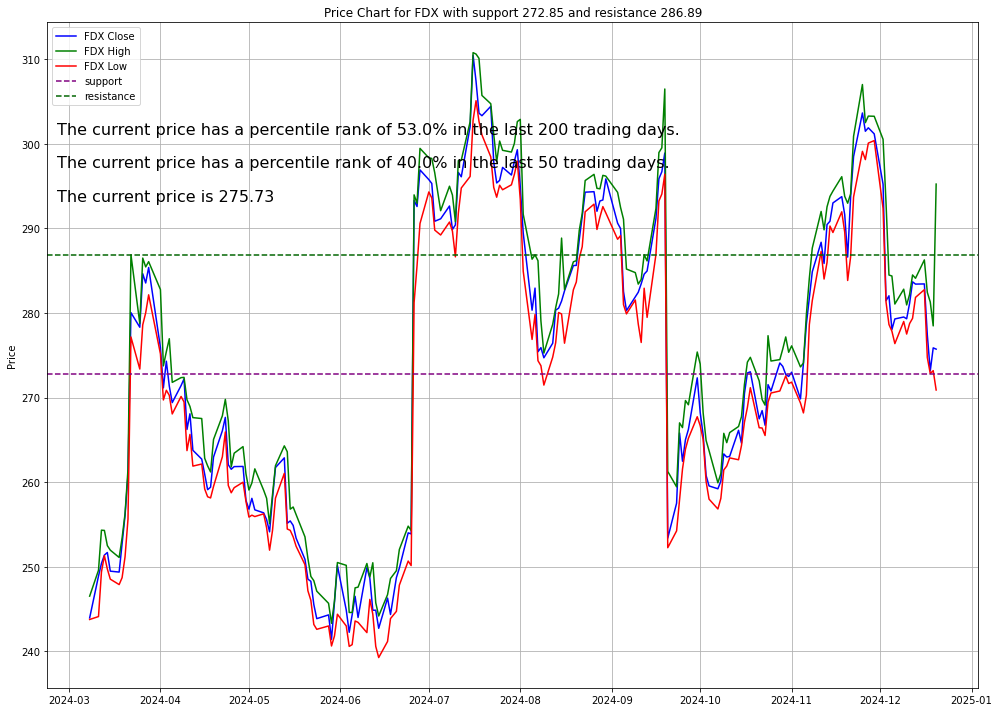

FedEx Corporation (FDX)

TD Cowen raised its price target for FedEx Corporation (NYSE:FDX) to $337 from $328, maintaining a Buy rating, following the company’s announcement of a spin-off of its freight business. The move positions FedEx as the largest public less-than-truckload (LTL) carrier by revenue. The analyst sees value creation through the spin-off, despite weaker core performance and expected reductions. FedEx’s ability to manage costs and its strong profitability metrics support its “FAIR” financial health rating. The adjustment reflects a sum-of-the-parts (SOTP) valuation, aligning more with industry peers, while FedEx’s long-standing dividend payments and cost-saving measures bolster investor confidence.

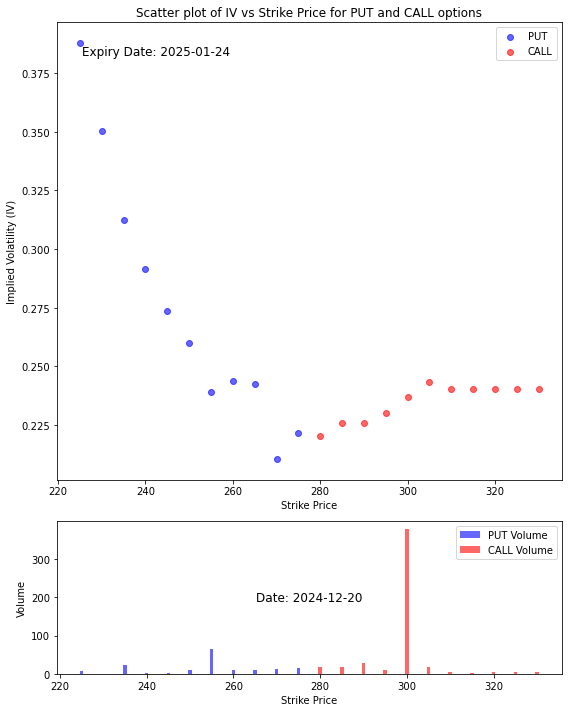

- Clearly many traders are betting that the price will in due time reach and surpass 300. However the implied volatilities constellation of the put and call options near the current price shows almost even countervailing forces that fight for dominance.

- Discounting a major macro event, it appears that the stock price will be heading to 300 although the path appears to be a long and winding road.

Darden Restaurants (DRI)

BMO Capital has raised its price target for Darden Restaurants (NYSE: DRI) to $175, reflecting stronger sales trend estimates and a roll-forward methodology to fiscal year 2026. The upgrade comes after Darden’s Q2 FY2025 earnings per share (EPS) of $2.03 exceeded expectations, driven by higher comparable sales and lower food costs. Despite these positive results, BMO Capital maintains a neutral stance on the stock due to ongoing challenges relative to industry standards. Darden has shown solid financial performance, with nearly 6% revenue growth and consistent dividend payments for 30 years. The company reaffirmed its full-year EPS guidance, but third-quarter growth is expected to be weaker than the fourth quarter.

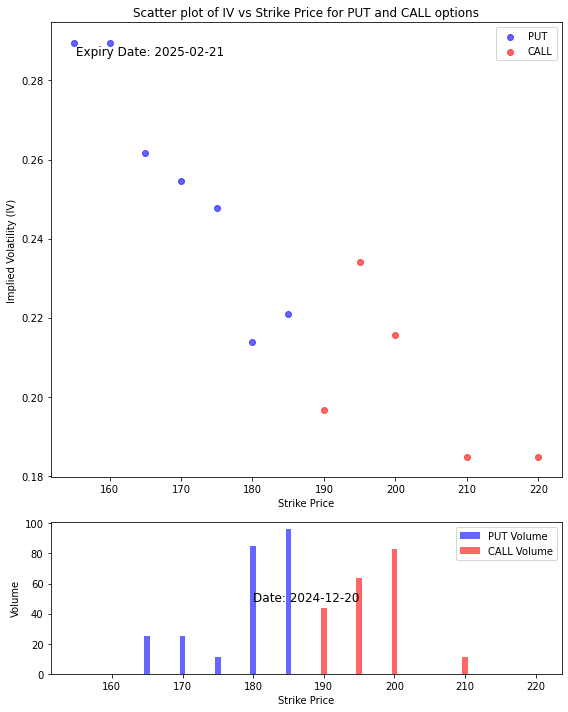

- The implied volatilities close to the current price shows erratic behaviour. Indicating that the market sentiment is still mix on the bullishness or bearishness in the coming price movement.

- However, the volume shows that the conviction is tilted towards bearishness.

Carnival Corp (CCL)

Carnival Corp (CCL) reported strong financial results for FY 2024, with a 47% higher free cash flow (FCF) margin and an 80% year-over-year increase in operating income. The company’s adjusted FCF reached $3.657 billion, up 70.4% from the previous year. Looking ahead to FY 2025, Carnival projects a 20% increase in adjusted net income and a 8.2% rise in adjusted EBITDA. Analysts expect continued FCF growth, estimating a 19.5% increase in FCF for FY 2025, potentially boosting CCL’s stock price. Using a 10% FCF yield metric, the stock’s target price is raised to $32.50, indicating a 22% upside from its current price of $26.63. Analyst price targets have also risen significantly, reflecting growing confidence in CCL’s outlook.

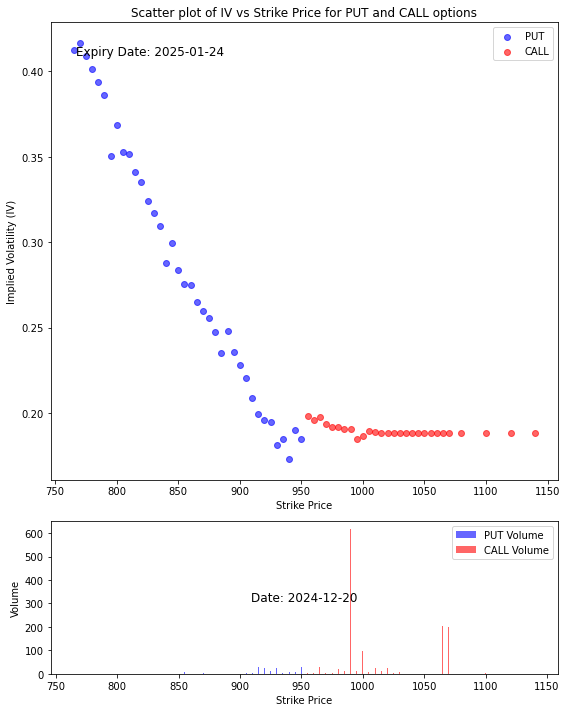

- The implied volatilities of the put and call options show that the market is anticipating the stock price to be in the range between 24 to 27 in the near future. Of course that is discounting any major macro event.

Costco (COST)

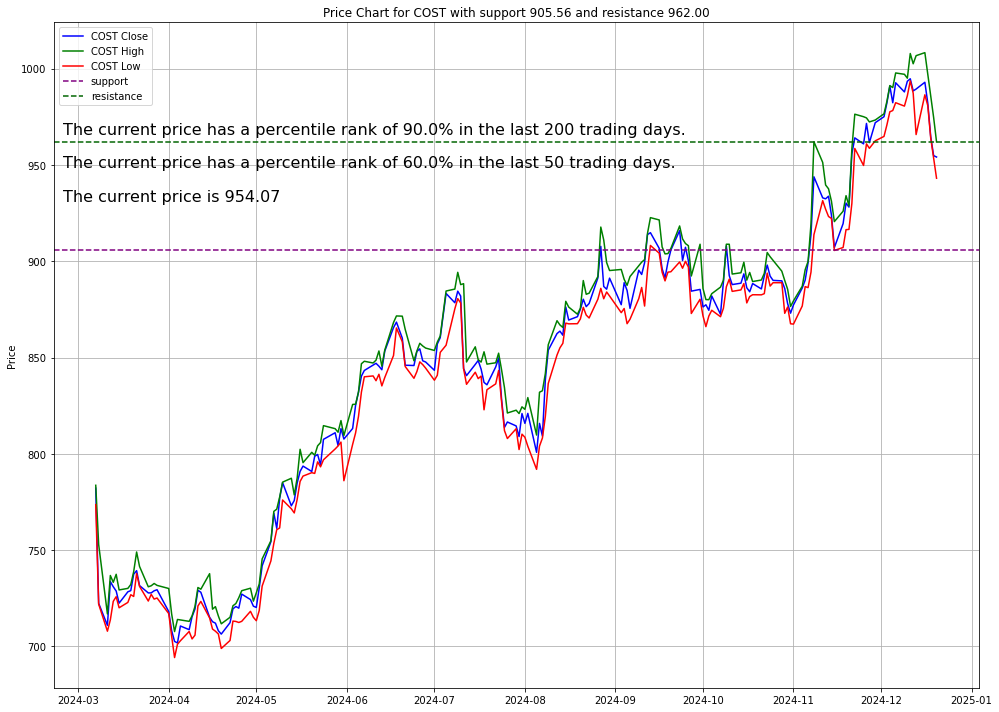

Costco‘s business model remains strong, offering value to its 77 million members through low-priced products and its unique membership fees, but the stock has become increasingly overvalued. Trading at 53 times projected earnings, Costco’s P/E ratio is significantly higher than its growth potential, especially when compared to other leading companies. Despite strong financial performance and steady global expansion, Costco’s growth rate of 10% annually and its high valuation make it difficult to justify its current stock price. Analysts believe the stock could experience a decline if its growth does not accelerate, and its high valuation could lead to underperformance in the future. While the company remains one of the highest-quality retailers, it faces challenges in maintaining its growth trajectory, particularly with its large size and limited room for expansion in the U.S. market. Consequently, while Costco’s business is solid, its stock is likely priced too high for future gains.

- Based on this data, one might infer that the market is somewhat cautious, with investors hedging against potential downside risk while still holding a moderate bullish sentiment. The price might continue to hover within the range around 950 to 1050, potentially testing the 950 level in the short term if the bearish pressure from the PUT options dominates.

- However, the price could also move upwards towards 1050 or higher, depending on shifts in investor sentiment, especially if market conditions lead to stronger bullish momentum, reflected in the increased CALL volumes. The combination of these factors indicates some uncertainty, but overall, the price may remain range-bound unless a major catalyst emerges.

CONCLUSION

In 2025, the U.S. economy will continue to be shaped by a mix of domestic policy decisions and international factors.

While signs of recovery are emerging in the housing market, stock market, and agricultural sector, the ongoing challenges from international trade tensions, particularly with China, and the agricultural downturn, will remain significant.

Despite stocks rebounded, the Federal Reserve’s actions on interest rates and fiscal policies will be crucial in setting the economic tone for the year.

The global chip supply chain remains a key battleground, with U.S. companies closely monitoring China’s increasing chip production.

This tension is expected to impact other sectors, complicating the economic landscape.

Additionally, the agricultural recession, combined with tariffs and trade wars, will require careful policy management to prevent further destabilization.

The coming year will be critical for the U.S. economy, as investors and policymakers navigate a complex web of domestic and international challenges.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.