Typically most investors only look at the total return since inception till date to gauge on the quality of the investment strategy. This is one of the common flaws that prevent investors from generating high and consistent returns over the long run. Investors tend to forget that past performance of an investment product will not predict the future performance of the investment product. For example, if the strategy is invested into a portfolio of stocks with high correlation to a benchmark index(like most mutual funds) that generate high returns during a certain historical period then obviously the strategy(or fund) will also generate high returns.

The problem is that when an investor gets into such investment, the performance is already in the past and it is like betting that the trend of the benchmark index will continue. Holding on to such a trend is a gamble. For example from 2010 to 2015, the benchmark index for biotech stocks gained about 5X of its original value during the 5 years period. However from 2015 to 2020, the benchmark index gain is negative within this 5 years. We saw the same with most biotech mutual funds.

However, are we saying that investing in a strategy(or fund) is always a gamble because it must rely on the trend of the benchmark index? The answer is ‘No’ if the strategy (or fund) is able to accurately time when to enter or exit from the portfolio and to identify the ‘fittest’ stocks or products inside the portfolio.

Thus the key is to make the strategy (or fund) be able to generate high returns consistently and minimally impacted by the benchmark index. The strategy (or fund) has to be managed by a very skillful trader to achieve such consistent performance. Therefore,when an investor will like to invest into a strategy(or fund), the investor must not look at the past absolute return but instead the investor must gauge whether the strategy (or fund) is run by a very skillful trader.

Many financial advisors will only sell big brands to the likes of BlackRock, and Fidelity to convince an investor to invest into a strategy (or fund). But as a savvy investor you need to identify the good strategy (or fund) objectively by quantifying the ‘Alpha’ of the strategy and the ‘Beta’ of the strategy, which is an accurate gauge on whether the strategy (or fund) is skillfully managed. A good consistent strategy will have ‘High Alpha’ and ‘Low Beta’. In short, we call it Alpha Strategy.

WHAT IS ALPHA?

Alpha is an excess return of a strategy that is not correlated with the benchmark index or general market, commonly known as Beta.

The Alpha is generated by intelligent selection of the stocks or investment product and the right entry-exit timing. For example when a strategy generates 20% return and the Alpha is 18%, then we can estimate that 90% (majority) of the strategy’s return is attributed to its Alpha component and therefore we can consider this as an Alpha strategy. With an Alpha strategy, we can outperform the benchmark index and generate high returns even if the benchmark index or general market is performing poorly.

Mutual funds, ETFs or robo advisors are mostly Beta strategies which most retail investors are invested in.

When Alpha strategies are mentioned, Hedge funds come to mind for most. As it is challenging to generate stable Alpha and only a few hedge fund managers that have the skills to create Alpha strategies. They are able to generate double digits positive return in the long run and generate positive return throughout market crises. However, their funds are typically not accessible to retail as many require a minimum of USD $10 Million investments.

WHY IS TRIDENT AN ALPHA STRATEGY?

Algomerchant’s Trident robot is a very good example of an Alpha Strategy for stock trading.

To illustrate the concept of Alpha, and its divergence from the general market’s behaviour ‘Beta’, let us examine Trident during the 2020 Covid-19 market sell down.

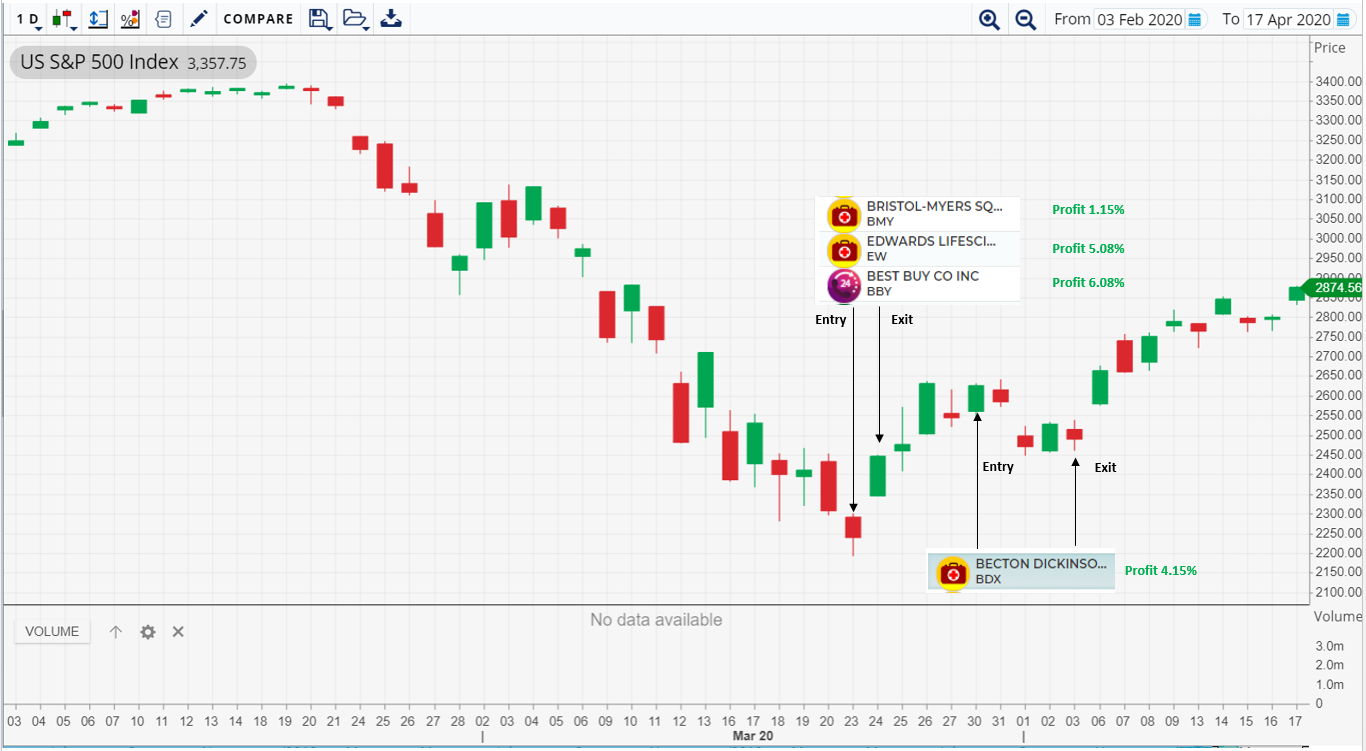

The screenshot below depicts all the Trident positions taken before the Covid-19 selldown, and those entered and exited during the Covid-19 sell down. In summary, assuming if all the trades positions were of equal value, the overall drawdown is only -1.7% compared to the -38% drawdown in the general market!

HOW DOES TRIDENT LIMIT VOLATILITY YET REMAIN PROFITABLE?

Trident is a complex machine and churns massive amounts of data that will probably implode the human brain CPU. To humanise Trident will not do her justice, but it can be summarised she adopts a statistical edge approach to trading. What this simply means is if statistically she sustains losses, she keeps the loss percentages small and win percentages high. Trident has to date 73.2% win rates, so statistically she wins more than she loses by total trade counts. Trident’s reward to risk ratio is 1.21 to date, which means that on average for every trade she enters statistically it has proven to win by value 1.2 times more than it loses by value.

If we move away from looking at Trident with statistical tinted lenses, there are also several ways we can qualify Trident as an Alpha strategy that actively seeks to avoid volatility and drawdowns:

1

Limiting Time Exposure – The maximum period Trident will hang on to a position is 3 weeks. In extreme sell down conditions we have seen Trident enter and exit trades with 2 trading days. Thus, Trident does not buy and hold for the long term. It does this so that she avoids general market beta risk exposures.

2

Buying when markets are inefficient – Imagine this, if you are able to consistently buy at the market lows, and stay position free when markets are free falling, will you consider such a strategy as low risk and low volatility? This is exactly what Trident does and how she behaves in general. One way to look at this is Trident is able to take the good out of markets when markets are bullish, remove the part and parcel of the beta portion of market drawdowns/losses during selldowns!

3

Smart Cash to Equities Ratio Allocation – In general, when markets are on a long term bull run, Trident tends to take on minimal trade positions at any point in time. However (to every investors’ benefit of course), Trident will put more of your capital to work by entering into more trade positions during periods of market inefficiency!

TRIDENT PERFORMANCE ON 2020 COVID-19 SELL DOWN

Let’s begin a detailed step by step process breakdown of how Trident traded, before and during this Covid-19 episode. This will allow readers to appreciate how trading in an equities only system can result in lower risk and volatility levels, compared to conventional safe havens like retirement funds.

The series of charts below has specially been tailored to express the stock positions taken by Trident with respect to the general market movement like S&P 500.

The first chart (right below) summarises the only 2 positions held by Trident before the Covid-19 sell down on 24th Feb 2020. What is interesting to note is that even though the Diamondback Energy position held suffered a significant drawdown (-18.4%) upon exit, the HESS position maintained a healthy profit (4.36%) despite the general market selldown.

Between 24th Feb 2020 and 1st March 2020, Trident was intelligent enough not to enter into any risky long trades (Trident only exited the 2 oil stock positions during this period). Instead, it waited for a short term market rebound and did 5 quick turnaround long trades on 2nd March with exits on 3rd March 2020 (Microsoft, Molson Coors, Transdigm, Huntington, and Raytheon) which were 100% profitable (17.38%). As of 3rd March 2020, Trident maintained a profitable portfolio at 3.34%.

Between 4th and 8th March 2020, Trident was once again intelligent enough not to enter into any risky long trades, when markets were effectively on a one way track downwards. Trident therefore was 100% position free during a free fall period. It entered into a long trade with GM that would eventually prove to be statistically costly with a position loss of -31.7%. Thereafter, it waited for another short term market rebound and did 2 quick turnaround long trades on 16th March with exits on 17th March 2020 (Skyworks and Iqvia) which were 100% profitable (8.88%). As of 17th March 2020, Trident maintained a current loss position at -19.48%.

Between 18th and 20th March 2020, Trident was once again intelligent enough not to enter into any risky long trades, when markets were selling down. On 23th March 2020, Trident literally entered into 3 long trades (Bristol, Edwards & Best Buy) at market bottom which were 100% profitable (12.31%). The same stance was repeated with Becton Dickinson at 4.15% from 30th March to 3rd April 2020. As of 4th April 2020, Trident maintained a nominal loss position at -1.7%.

WHAT MAKES TRIDENT SO UNIQUE?

Interestingly, when you scour the financial literature, articles, tweets and experiences shared by Traders and Investors, you will often read that when it comes to equities trading/investment it is commonly acknowledged to be a high risk and high reward venture. Risk and volatility can almost be thought of as being part and parcel of an investor/trader’s path towards rewards. One has to come with the other – just no two ways about it.

With Trident, we have a proven technology that defies this conventional thinking. The only reason why Trident has time and again proven different and unique, is because she adopts what is loosely termed as Alpha strategies. In a nutshell, an Alpha strategy simply has little or no correlation to general market risks/returns or what is commonly known as Beta.

For clarity, not all Alpha strategies trade in the same way, and can often have very different behaviours and approaches to generating higher than expected returns when markets are bullish, and lower than market losses during selldowns, which believe you me, will be what many will expect. In fact, you may often find many Alpha strategies in the market that do generate very aggressive returns during bull runs, and correspondingly high losses during bear markets. One can very well classify such extreme strategies under the umbrella of Alpha strategies.

However, at Algomerchant, we adopt a stricter definition of Alpha. The way we view Alpha is higher than expected returns during bull runs, and lower than market losses during massive selldowns.