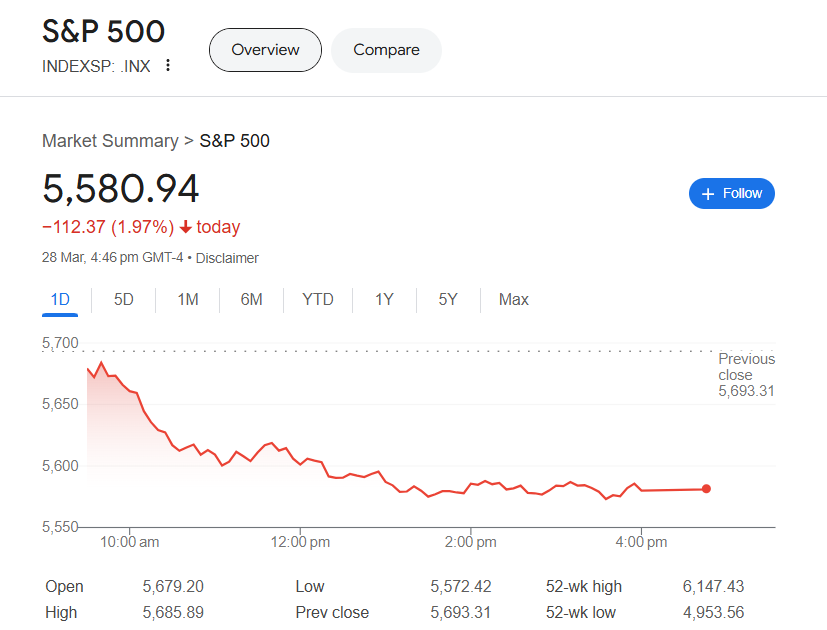

U.S. stocks experienced a significant downturn on March 28, 2025, with major indices closing notably lower. The Dow Jones Industrial Average fell by 1.69%, the S&P 500 dropped 1.97%, and the NASDAQ Composite declined by 2.70%. Losses were concentrated in the Technology, Consumer Services, and Industrials sectors, reflecting broader market unease.

Declining stocks vastly outnumbered advancers, with 2,202 falling versus 595 rising on the NYSE and 2,742 declining against 565 gaining on the NASDAQ. The CBOE Volatility Index (VIX) spiked 15.84% to 21.65, underscoring heightened investor anxiety. Commodities showed mixed movements, with gold rising 0.82% to $3,116.39 per ounce, while crude oil prices fell over 1%.

Consumer Sentiment Hits Multi-Year Low Amid Economic Concerns

The University of Michigan’s Consumer Sentiment Index dropped sharply to 57 in March, its lowest level since 2022. Future expectations reached a 12-year low, driven by worries over tariffs, federal layoffs, and immigration policies. Businesses echoed this pessimism, with CFO surveys indicating declining optimism, particularly among firms exposed to trade disruptions.

Source: Bloomberg

This weakening sentiment is already translating into softer economic activity. Consumer spending growth in February fell short of expectations, prompting economists to downgrade Q1 GDP estimates to a mere 0.4% annualized rate, down from 2.4% in Q4 2024. While unemployment remains low at 4.1%, fading pandemic savings and hiring slowdowns are eroding household financial buffers.

Still, spending patterns remain uneven across income groups. High-savings households continue to spend despite economic worries, as seen in strong travel and leisure activity. However, others, particularly in rural areas affected by federal cuts, are tightening budgets. At the same time, businesses are delaying expansions due to policy instability, raising risks of a broader economic slowdown.

Top and Bottom Performers Across Major Indices

The Dow Jones Industrial Average saw Merck & Company Inc lead gains with a 1.86% rise, while Amazon.com Inc suffered the steepest drop at 4.33%. On the S&P 500, W. R. Berkley Corp surged 7.53%, whereas Lululemon Athletica Inc plummeted 14.25%. The NASDAQ Composite had extreme movers, with Portage Biotech Inc skyrocketing 103.81% and Sharps Technology Inc collapsing 72.43%.

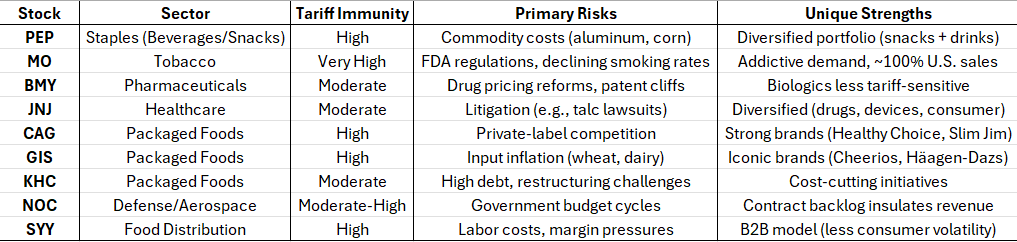

Suggested stocks that may be immune to the Trump tariff debacle

Here are the stocks that may display resilience to the Trump tariff saga.

PEP, MO, BMY, JNJ, CAG, GIS, KHC, NOC, SYY

Similarities: Why These Stocks Are Considered Defensive

1. Domestic Revenue Focus:

- Most derive a significant portion of revenue from the U.S. (e.g., MO ~100%, SYY ~90%, CAG/GIS ~80%), reducing direct exposure to global trade disputes.

- Exceptions: BMY and JNJ have substantial international sales (~30–50%), but their healthcare products face less tariff sensitivity.

2. Pricing Power & Inelastic Demand:

- Essential products: Food (PEP, CAG, GIS, KHC), tobacco (MO), healthcare (BMY, JNJ), and defense (NOC) are non-discretionary.

- Consumers prioritize these even during downturns, allowing companies to pass on costs.

3. Limited Supply Chain Reliance on China:

- Minimal exposure to tariff-vulnerable inputs (vs. tech or autos). Exceptions include KHC (some packaging materials) and NOC (aerospace parts).

4. Dividend Aristocrats:

- Many are dividend stalwarts (JNJ, PEP, MO, GIS) with long payout histories, appealing to risk-averse investors.

Differences: Risks and Nuances

Tariff Impact Ranking (Most to Least Immune)

1. MO – tobacco is ultra-defensive, purely domestic.

2. SYY – food distribution, B2B focus.

3. PEP/GIS/CAG – staples, but input costs matter.

4. NOC – defense contracts are politically shielded.

5. JNJ/BMY – Stable healthcare demand, complex global sales.

6. KHC – higher debt and restructuring needs to amplify risks.

CONCLUSION

- Market slump and declining sentiment signal growing economic fragility.

- Tariffs and fiscal uncertainty are key factors weighing on confidence.

- Weak confidence could impact spending, investment, and hiring.

- Investors should watch for volatility and shifts in consumer behavior.

- Policymakers face pressure to stabilize expectations and restore confidence.

- Historical declines in sentiment have preceded past recessions (1990, 2008).

- Despite stable employment and production, weakening spending and cautious investments may hint at future economic downturns.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.