Wall Street stocks advanced on Friday, marking the second consecutive week of gains. The upward momentum was fueled by strong economic data and the potential easing of trade tensions between the U.S. and China. Despite recent concerns about a slowing economy, the market reacted positively to the release of job data for April, which exceeded expectations and helped offset worries about a contraction in U.S. GDP.

Advancing issues outnumbered decliners by a 3.81-to-1 ratio on the NYSE. There were 144 new highs and 47 new lows on the NYSE, while the S&P 500 posted 12 new 52-week highs and 3 new lows. The Nasdaq Composite recorded 51 new highs and 38 new lows.

Total volume on U.S. exchanges was 15.99 billion shares, compared to the 19.3 billion average for the full session over the last 20 trading days.

Wall Street Rallies as S&P 500 and Dow Notch 9-Day Winning Streaks

The S&P 500 reached its ninth consecutive session of gains, matching a winning streak from 2004. The Dow Jones Industrial Average also posted a nine-day winning streak, the first of its kind since December 2023. For the week, the S&P 500 gained 2.9%, the Dow rose by 3%, and the Nasdaq saw a 3.43% increase.

- Dow Jones Industrial Average: Rose 564.47 points (+1.39%) to 41,317.43

- S&P 500: Gained 82.54 points (+1.47%) to 5,686.68

- Nasdaq Composite: Increased by 266.99 points (+1.51%) to 17,977.73

Source: India Today

Apple Drops on Tariff Jitters and Buyback Cut Despite Tech Sector Gains

Apple (NASDAQ: AAPL) saw a nearly 4% decline after the company announced a $10 billion reduction in its share buyback program. CEO Tim Cook also noted that tariffs could add approximately $900 million in costs for the current quarter.

Source: Reuters

Other major tech stocks, however, performed well, with Meta (NASDAQ: META) rising 4.3% and Nvidia (NASDAQ: NVDA) gaining 2.6%. Amazon (NASDAQ: AMZN) experienced a slight dip of 0.1%.

Chevron and ExxonMobil Climb on Strong Quarterly Earnings

Energy giants Chevron (NYSE: CVX) and ExxonMobil (NYSE: XOM) both reported strong quarterly results, with Chevron rising 1.6% and ExxonMobil adding 0.4% to its share price.

Source: Yahoo Finance

Block Plunges, Take-Two Slides on Profit Cut and GTA VI Delay

Block (NYSE: SQ) saw a sharp drop of 20% after cutting its profit forecast for 2025 and missing estimates for quarterly earnings. Similarly, video game maker Take-Two Interactive (NASDAQ: TTWO) fell nearly 7% after announcing a delay in the release of its highly anticipated “Grand Theft Auto VI” to May 2026.

Source: TechPowerUp

Job Gains Beat Forecasts, But Hiring Momentum Eases

The U.S. economy added 177,000 jobs in April, surpassing analysts’ expectations, with the unemployment rate holding steady at 4.2%. This stronger-than-expected job growth helped ease concerns about an economic slowdown. However, there were signs of a slight deceleration in job creation, as noted by Talley Leger, chief market strategist at The Wealth Consulting Group, who commented that job growth had slowed compared to previous months—though the market remained optimistic.

Source: The National Desk

Despite the solid April jobs report, many major employers are beginning to slow down their hiring efforts in response to ongoing economic uncertainty. Some have even opted to freeze positions altogether to manage costs amid a volatile trade environment, including the U.S.-China trade war. Companies like JetBlue, T. Rowe Price, and various universities have either paused hiring or become more selective in recruitment. While widespread layoffs have not occurred, employers are showing greater caution—especially with entry-level roles. Some firms, such as Polaris, have halted hiring entirely as part of broader cost-cutting strategies. As a result, the job market has become more challenging for job seekers, particularly those entering the workforce, signaling a potential slowdown in new investment and economic growth.

Homebuilders Slash Prices as Tariffs and High Rates Hit Spring Sales

Home builders are facing a slowdown in the housing market as the spring buying season has underperformed expectations. Builders are offering significant incentives like mortgage-rate buydowns, price cuts, and design upgrades to entice buyers, while simultaneously contending with rising construction costs driven by tariffs on imports. Despite these efforts, the market remains sluggish, particularly for entry-level buyers, who are finding it harder to afford homes due to high mortgage rates and increasing competition from existing homeowners. Major builders such as D.R. Horton and Lennar are offering discounts amounting to 7.2% of the home purchase price, a significant increase from earlier in the year. While the long-term outlook remains positive due to the ongoing housing shortage, builders’ profits are under pressure as they work to reduce unsold inventory. The rising costs and affordability challenges are expected to keep profit margins squeezed for the foreseeable future.

Source: WSJ

International Issues

Beijing Considers Tariff Talks as Wall Street Recovers Ground

On the trade front, Beijing announced that it was evaluating an offer from Washington to hold talks over President Donald Trump’s 145% tariffs imposed on Chinese imports. These tariffs have been a point of contention between the two largest global economies, adding uncertainty to markets. Despite the ongoing trade war, U.S. stock indexes have recovered, with the S&P 500 now up 0.3% since the close of April 2, and the Nasdaq trading at levels last seen before Trump’s tariff announcement.

Source: The Business Times

Tariffs Fuel Manufacturing Revival

Trump’s tariffs on imports, particularly the 145% tax on Chinese goods, have led to increased demand for U.S.-made products as companies seek to avoid tariff costs. Smaller and mid-sized manufacturers are benefitting from a surge in orders, as businesses shift their production from overseas to the U.S. to avoid higher import taxes. For example, manufacturers like Jergens Inc. and Grand River Rubber & Plastics have seen new inquiries and orders from companies returning to domestic suppliers. However, not all manufacturers are thriving; some, like Husco International, are grappling with rising costs due to their dependence on Chinese materials. While smaller companies are hopeful, the uncertainty surrounding the longevity of these tariffs has left many hesitant to expand production or hire new workers. Overall, the tariffs are providing a boost to some U.S. sectors but are also increasing production costs for others.

Source: Bloomberg

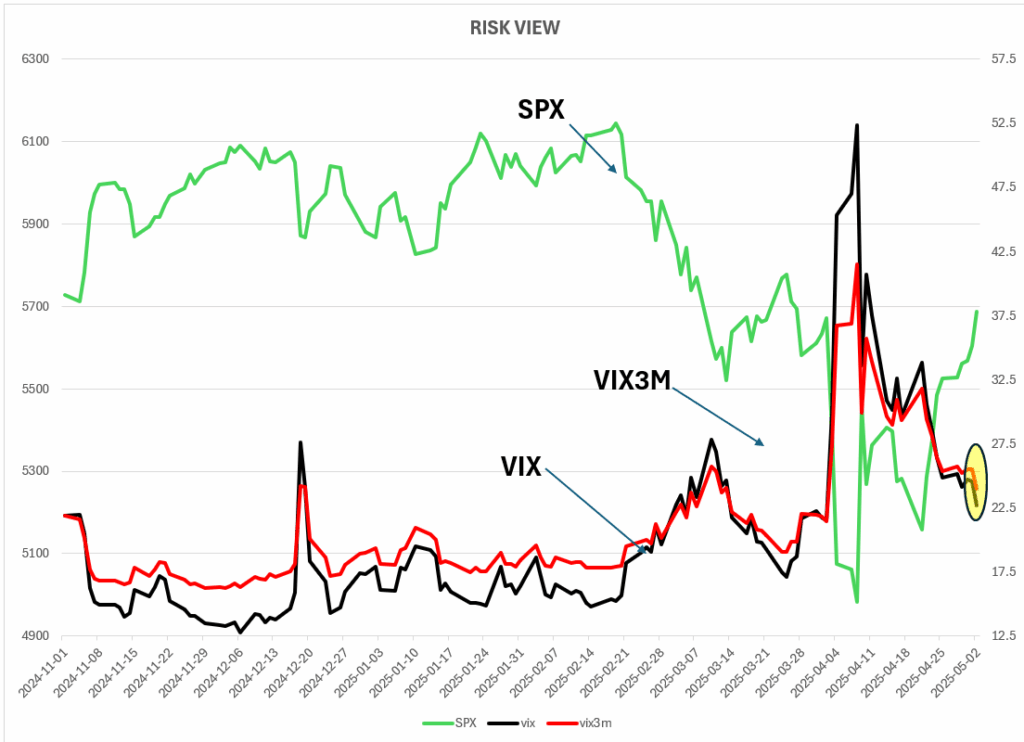

Market Risk

We are getting closer to when we can start going bullish again.

CONCLUSION

- The U.S. stock market has remained resilient despite persistent challenges such as trade tensions and rising costs.

- Strong job growth in April signals economic strength, but companies are still cautious about hiring due to ongoing uncertainty.

- Tariffs continue to affect manufacturers—while some face rising input costs, others are benefiting from reshoring trends.

- The housing market is slowing, with builders offering significant discounts to attract buyers amid high construction costs.

- Looking ahead, cautious optimism prevails, with hopes that current challenges will stabilize and support a more bullish market outlook.

Please note that all information in this newsletter is for illustration and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any investment products or services.

About the Author

Rein Chua is the co-founder and Head of Training at AlgoMerchant. He has over 15 years of experience in cross-asset trading, portfolio management, and entrepreneurship. Major media outlets like Business Times, Yahoo News, and TechInAsia have featured him. Rein has spoken at financial institutions such as SGX, IDX, and ShareInvestor, sharing insights on the future of investing influenced by Artificial Intelligence and finance. He also founded the InvestPro Channel to educate traders and investors.

Rein Chua

Quant Trader, Investor, Financial Analyst, Vlogger, & Writer.