Introduction

Did you know that a rare bearish “inverse signal” appeared for the first time in 79 years? It occurred only 11 instances in the past 91 years since 1931.

This rare data signal is called “Inverse Zweig Breadth Collapse!”

In the last data insight article, we covered a bullish signal called “Back-to-Back-to-Back 80% Up Days” and its possible upside scenarios. However, on the 10th of June, an even rarer bearish signal appeared after almost eight decades.

In this noteworthy data insight article, we will cover the other side of the spectrum to give you a comprehensive view of how this signal could warn us about a possible downside for the S&P 500!

This article is inspired by Rob Hanna’s post on QuantifiableEdges.com after his extraordinary finding of this rare signal being triggered by the current market sentiment.

We will explore his findings and give you a detailed look at this rare signal so our readers can better appreciate how preparation for the worst-case scenario based on historical and factual context can help in your assessment of current and future market conditions.

WHAT IS THE SIGNAL?

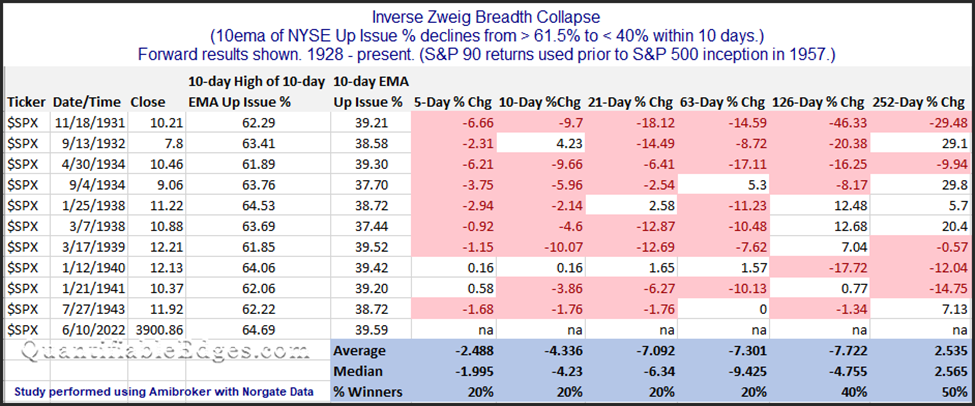

The signal is called “Inverse Zweig Breadth Collapse.” It is essentially the opposite of the “Zweig Breadth Thrust,” which uses a 10-day exponential moving average (EMA) on the NYSE Up Issues % to look for a move from < 40% to over 61.5% within a 10-day EMA period to identify a breadth thrust.

For the last three trading days leading up to the 10th of June, the S&P 500 formed an inverse setup trigger where the NYSE Up Issues % 10 EMA fell from above 61.5% to under 40% in 10 trading days. Thus, instead of a breadth thrust, it formed a rare “breadth collapse.”

HISTORICAL DATA OF INVERSE ZWEIG BREADTH COLLAPSE

Source: https://quantifiableedges.com/a-rare-inverse-zweig-breadth-collapse-triggers/

As shown, from the oldest breadth collapse manifesting for the first time in 1931, there were only ten instances within 12 years (1931 to 1943) that triggered this inverse signal. Note that during this timeframe, the primary S&P index basket was the S&P 90.

After the last inverse signal was triggered in 1943, and the current index basket, the S&P 500 was introduced in 1957, there has only been one instance where this breadth collapse has been triggered in 79 years. This historical instance happened recently on the 10th of June, 2022.

Looking at the drawdown between 1931 and 1943, on average:

the 5-day (one week) loss is about -2.5%

the 10-day (two weeks) loss is at -4.3%

the 21-day (one month) loss is at -7.1%

the 63-day (three months) loss is at –7.3%

the 126-day (six months) loss is at -7.7%

the 252-day (one year) loss is at –2.5%

On average, the losses gradually compound from the first week to the sixth month from the trigger date. After that, it then tapers off its losses from the sixth month to the first year.

|

Thus, based on the historical data of this rare inverse signal, there is a higher probability that the S&P 500 index will experience a compounding drawdown for at least six months. |

PRICE ACTION MOVEMENT OF THE S&P 500

As you can see, since the start of the year, S&P 500 has continuously slid. From its high of around 4,800 to the current 3,750, slashing a staggering 1000 points or roughly -22% in a span of five and a half months.

Paying a closer look at the signal date on the 10th of June, it marked the sharpest gap down from its previous close, signifying a strong selling pressure to the downside, breaking the 4,000-support level.

For context, you can see that the price closed at above 4,000 on the previous trading day on the 9th of June (Thursday), and on the date of the inverse signal, the 10th of June (Friday), S&P 500 opened at below 4000. Furthermore, the sharp decline is also notable as the 10-EMA failed to trail close to the candlestick.

Following the breadth collapse, on Monday, the 13th of June, a sharper gap down occurred as the S&P 500 opened at 3,830 and subsequently closed at 3,750 on Monday. A staggering -3.88% loss in a day.

INTERPRETATION

The huge selling pressure shown in the current price action movement of the S&P 500 could indicate that this rare inverse indicator has already started to manifest.

As always, only time will tell the whole picture if this is indeed the case. However, based on the current market sentiment and the historical data of the inverse signal, the probability seems to favour a bearish outcome.

FINAL WORDS

The rare “Inverse Zweig Breadth Collapse,” an inverse/bearish signal, has occurred for the first time in almost eight decades.

The inverse signal is essentially the opposite of the “Zweig Breadth Thrust,” which uses a 10-day exponential moving average (EMA) on the NYSE Up Issues % to identify a breadth thrust.

Based on historical data, on average, from the first week to the sixth month from the trigger date of this signal, the losses gradually compound. It then tapers off its losses from the sixth month to the first year.

Coinciding with the price action, the date of the signal on the 10th of June marked a sharp gap down of S&P 500 from its previous close, signifying a strong selling pressure to the downside, breaking the 4,000-support level.

This could indicate that this rare inverse indicator has already started to manifest. As always, only time will tell the complete picture if this is indeed the case. However, based on historical data, the probability seems to favour a bearish outcome.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.