On a warm summer eve, Liam was scrolling down his TikTok feed when he came across a trending video with the hashtag #moneystuffing.

A woman with beautiful acrylic nails was stuffing cash into envelopes with different categories.

“I am back with another money-stuffing video!” she announced.

And explained how a Savvy Saver leveraged money-stuffing to pay thousands of dollars of debt and even saved $5,000 in an emergency fund in only one year when the inflation was hitting from everywhere one could imagine.

And you know what the cherry on the cake is?

You, too, can start applying this budgeting technique right away to revolutionise your finances and keep yourself out of debt.

Even better, you can start for FREE!

All you need is a few ordinary envelopes, either store-bought or homemade. That’s it.

Sounds too good to be true? It probably is.

And yes, you also need to mix in some financial discipline, and then you’re good to go.

Here’s a closer look at how it works:

What is Money Stuffing?

The budget-savvy mom went viral on TikTok for her brilliant money hack, which really is a hands-on way to save money.

In a video, she shared a simple hack that puts the “fun” in funds and explained how she uses money stuffing to allocate a portion of cash from each paycheck into envelopes labelled for the top priority categories like:

- Groceries,

- Gas,

- Clothing,

- Household Items,

- Personal Care,

- Travel, and much more.

Whenever the payday arrives, budget-mom withdraws a portion of her paycheck from an ATM and leaves the rest in the bank.

Starting with a base pay of $1850, she systematically breaks down her monthly budget and allocates varying amounts of cash to each envelope depending upon her needs.

“Make sure the category limits you set are within your budget!”

For example, once she receives her monthly take-home salary,

- She withdraws $400 from the ATM,

- Deposits it in an envelope,

- Labels it as groceries, and

- Pays for groceries only with the money in that envelope.

Once the money from her “groceries” envelope is over, she can’t withdraw anything to pay for groceries until her next paycheck arrives.

This way, she keeps track of her expenses, controls overspending and saves money almost every month in her bank account.

She recommends rinsing and repeating the same process for each of the remaining categories.

Is it necessary to use Money Stuffing for all of your expenses?

No. Rent, taxes, electricity bills, car payments, insurance premiums, television and Internet charges are fixed expenses.

They can be set up on autopay from your savings account because these expenses are unchanged, and you don’t need to go to the bank every time you have a fixed expense.

Remember, the Money Stuffing is an excellent approach to push yourself to limit your discretionary spending.

Why not pay for everything online instead?

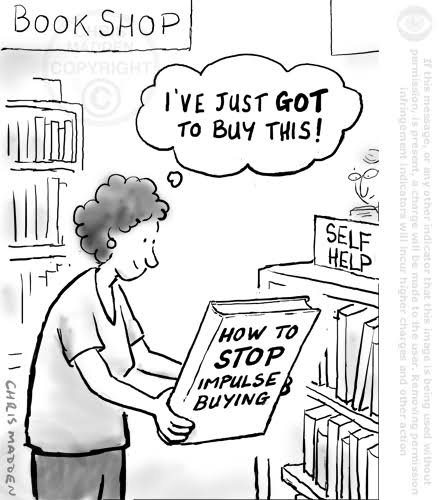

Online payments make it too easy to overspend. As you can’t really “see” your bill soaring or your bank account draining away, having cash in your hand allows you to resist impulse purchases you won’t ideally make.

Shopping with a fixed amount of cash-in-hand forces you to consider staying within your budget. It serves as a visual reminder whenever you become tempted to spend $10 on an unnecessary candy bar or grab those butter cookies at the checkout.

Digital forms of payments “decouple” the actual purchase and the pain of paying for it, especially when it comes to discretionary spending.

Here are some quick fixes:

#1: The Traditional Fix

As soon as you make an online payment for groceries, take the same amount from the Groceries envelope and deposit it in a new envelope labelled “Online shopping”.

And, make sure you don’t open this new envelope until your next paycheck.

On the payday, deposit the money from the “Online Shopping” envelope into your savings account or withdraw a lesser amount from the ATM and adjust your budget accordingly.

Of course, it demands honesty, discipline, and dedication. But the rewards will far outweigh the efforts.

#2: The Modern Fix

Alternatively, money stuffing can also be replicated without the need for cash.

Here are some alternatives:

- If you want the benefits and structure of money stuffing but don’t want to carry cash, explore apps like Goodbudget, YNAB, or Mvelopes, which allow you to mimic the system digitally for a modest price.

- If you’re seeking a cost-effective alternative, consider opening multiple savings accounts in the place of envelopes. It is the same system; just it is digital.

But remember, you’ll miss the visibility that the cash envelopes give you. Cash envelopes let you see exactly how much cash you have left to spend, all within your income limits.

“Money stuffing is a visual system which is why it’s so effective.”

Final Words

- Money stuffing isn’t hard to master, but financial discipline is key to its success.

- Even if you can replicate this technique electronically, getting a hold of your finances is extremely tough when doing it online. So, spending cash is an excellent way for anyone trying to avoid impulse purchases.

- The best aspect is that it encourages you to set goals appropriate for your financial situation and makes it simple to track your progress by counting the cash in each envelope.

- Finally, keep in mind that you are not required to spend each envelope down to zero every month. Cash left over means you spent less than planned. Pay down your debt, invest in the markets or put money aside for an emergency fund.

Please note that all the information contained in this newsletter is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.