TAKEAWAY

In an uncertain market with significant concerns to the downside, the allocation of fund investments are highly concentrated towards what is perceived as selective “high performing” investments, rather than being broad based which is typical of low uncertainty, bullish markets.

Comparing the market conditions and economic outlook for 2020 just a few months ago and at present – there is no doubt things have shifted. The Covid-19 spread dealt an unprecedented blow that impacted humans — and markets — all around the world. Many traders are wondering now, where do we go from here?

It is a fact the world is attempting to recover from the sudden hiatus in normal economic activities due to global lockdowns – by gradual easing. It is also a fact financial markets hitted a bottom, and have thus far shown a sustained recovery rally.

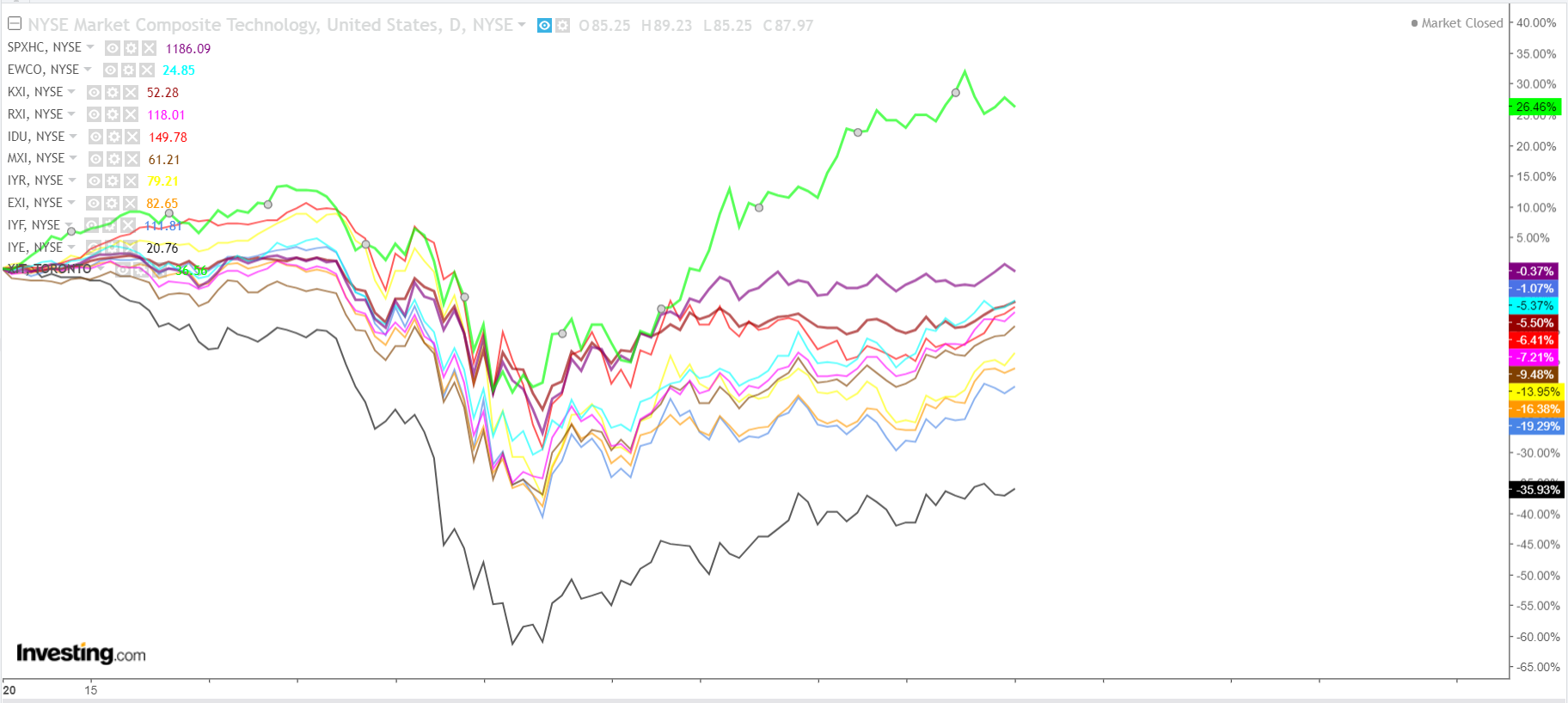

In this market outlook series, let’s examine the relative performances of the 11 key S&P 500 sectors, and also to share potential trade ideas from the insights provided.

S&P 500 Tech Sector (XIT).

The tech sector is currently 20.8% by weight in terms of the S&P 500 market capitalisation. Tech companies include manufacturers and sellers of computer hardware, software, semiconductors and computer equipment in addition to providers of IT services. Notable Companies include Apple, IBM, Microsoft and Cisco.

So far, the Tech Sector has been the clear winner, leading the pack at +26.46% since the start of 2020. It is also the only sector that has a positive return to date.

It is not hard to relate to the strength of the Tech sector. Technology has been a clear market darling with companies like Apple, Microsoft and Cisco all reporting strong guidance they can weather Covid-19, and investors have rewarded them for this resilience.

S&P 500 Health Sector (SPXHC).

The Health Sector takes up 14.9% by weight of the S&P 500 market capitalisation. This sector includes pharmaceutical manufacturers, hospitals, health care equipment and service providers, and biotechnology and life sciences companies. Prominent companies include Pfizer, Bristol-Myers Squibb and United Health.

So far, the Health Sector has been the 2nd leader of the pack at -0.37% since the start of 2020. It has been particularly strong on the back of Covid-19 treatment and vaccine R&D. The market has a clear expectation it is only a matter of time a vaccine will be developed, and manufactured on a mass scale upon success.

S&P 500 Communication Services Sector (EWCO).

The Communication Services Sector takes up 9.9% by weight of the S&P 500 market capitalisation. So far, this Sector is 3rd in line of the pack at -5.37% since the start of 2020.

In case you were wondering why this sector has been relatively strong, a restructuring of the sectors took place in 2018. This sector is renamed from the former Telecommunication Services sector, which was dominated by a handful of large telecom carriers such as AT&T, Verizon and T-Mobile. It now includes social media and traditional media companies as well as cable, landline and mobile telephone carriers.

With the restructuring, it was expanded to include some companies that had previously been in the Consumer Discretionary and Information Technology sectors. Those companies include Facebook, Google parent Alphabet, Netflix, Comcast which have all exhibited strong resilience throughout this pandemic.

S&P 500 Consumer Staple Sector (KXI).

The Consumer Staple Sector takes up 6.7% by weight of the S&P 500 market capitalisation. So far, this Sector is 4th in the pack at -5.5% since the start of 2020.

It is little wonder why this sector has shown resilience. Consumer staples generally consist of necessities, such as food and beverages and personal products. This includes producers of these goods as well as retail companies that sell them, such as supermarkets. Examples include Procter & Gamble, Kimberly-Clark, Coca-Cola and Costco.

S&P Mid Performance Tier Sectors (RXI, IDU, MXI).

These Sectors are Utilities, Consumer Discretionary, and Materials respectively.

Thus far their performances have been mid range, at -6.41%, -7.21%, and -9.48%.

Noteworthy of mention is the Consumer Discretionary Sector, which consists of businesses whose demand fluctuates based on general economic conditions, such as consumer durables, automobiles, hotels and restaurants, retailers and the like. Companies in this sector include Amazon, General Motors, Hilton and Nike. It should be highlighted the range of individual stock performance in this group is very wide. The likes of Amazon have already broken new highs in May 2020, while businesses like General Motors and Hilton have been on the weaker side of the spectrum due to poor business demands.

Investors should take note the bulk of businesses in this Sector have been adversely affected by the pandemic, less minorities like Amazon.

S&P Low Performance Tier Sectors (IYR, EXI, IYF).

These Sectors are Real Estate, Industrials and Financials respectively.

Thus far their relative performances have been at the lower end of the range, at -13.95%, -16.38%, and -19.29%. This is understandably so as these Sectors have been adversely affected by the general slowdown in business activities due to global lockdowns and weak market sentiment.

S&P Energy Sector (IYE). This is the weakest Sector in S&P 500 and understandably so due to weak energy demand. Oil prices in April 2020 even went to negative prices momentarily, indicating weak demand in a volatile energy market dealing with oversupply issues.

To date, the Energy Sector has been very weak with a -35.93% performance.

Conclusion

In a weak global economy with numerous outstanding concerns and uncertainty, history has proven the broad market sentiment will remain weak, with a selected few stocks and sectors primed to do well. In the current condition, that Sector has exclusively been TECH.

Should these trends continue to be true, a relatively low risk strategy traders may capitalize on, is to buy into a basket of good performance Sectors like Tech, Healthcare, Communication Services, and Consumer Staples and sell into a basket of Energy, Real Estate, Industrials and Financial Sectors stocks.