Introduction

As the Fed is going to start its rate hike cycle, might the markets rally as counter-intuitive as it may sound?

No, you haven’t got it wrong. Even though conventional wisdom tells us that whenever the US federal reserve hikes rates, the stock market falls. That’s what everybody thinks should logically occur.

Sometimes, the market behaves in a counter intuitive manner, and taking the contrarian view might result in being on the right side of the stock market performance.

In this article, we’re going to discuss how the Fed’s new approach to inflation, might actually rally the stock market.

Key Takeaways:

- Markets can sometimes behave in non-intuitive ways that differ from common news headlines and conventional economic theory

- Sometimes taking the contrarian view might result in being on the right side of the stock market

- Unlike what most people would expect, the stock market may already have looked past the issue of upcoming aggressive Fed rate hikes, and instead will be focusing on how aggressively the Fed tackles inflation by tightening.

- This might be because the Fed has acknowledged they were wrong about inflation being ‘transitory’, and inflation is looking to be more persistent than expected.

- This could imply that the market now expects the Fed to tackle inflation aggressively because persistent inflation is actually bad for the economy.

How is the Economy Currently Performing

Americans are facing contradictory signals about the economy’s performance. On the one hand, the economy is growing rapidly, Covid unemployment is improving, and wages are rising. Yet, in contrast, inflation is at a four-decade high.

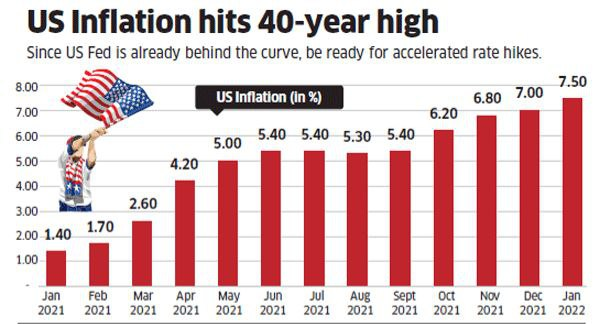

For the 12 months ending in January, inflation amounted to 7.5%, the fastest YoY growth since 1982, far exceeding the Federal Reserve’s target of 2% and thus, prompting FED to raise interest rates in the coming months.

GDP increased by 6.9% in the fourth quarter, the highest since 1984, due to healthier domestic demand and a stronger external sector.

How FED was Wrong on Inflation

As the greatest inflation spike in 40 years occurs, it is no exaggeration to say that the Fed failed to properly anticipate the inflation surge and is now way behind the curve. In fact, they were stuck on a “Transitory Inflation” narrative between 2020 to 2021.

When inflation was only 1.7% in early 2021 versus their 2% target, the Fed officials were relaxed with their temporary policies and shrugged off raising interest rates despite actually seeing the data with inflation above 2%.

Inflation again became hard to overlook around the summer of 2021. Yet Fed officials blamed supply-chain restraints as the primary culprit of the rising inflation and believed that current high inflation readings are likely to be transitory.

Now, when the inflation is over 7%, the Fed suddenly becomes extremely conscious to control inflation.

Interest Rate Expectations

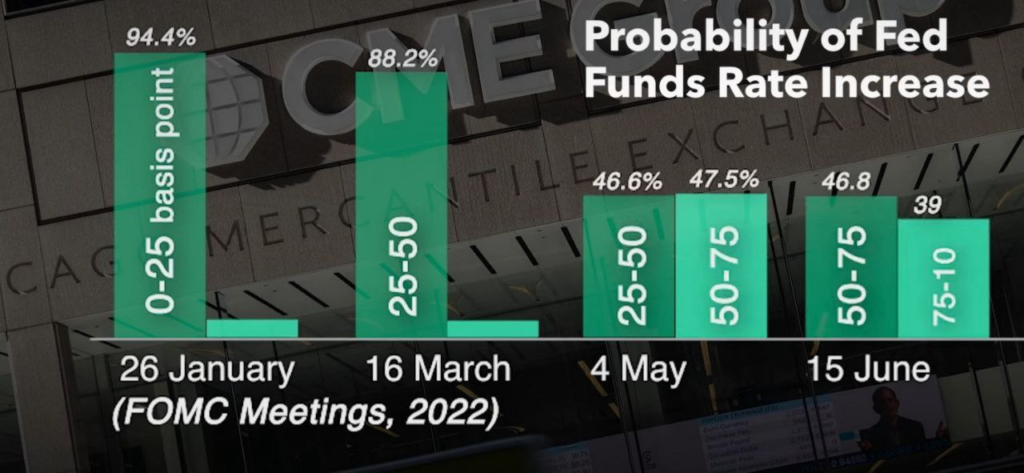

In december of 2021, the Bank of England raised its bank rate by 0.15%. The market feels that the US central bank will quickly follow suit to tame the soaring prices, and is expecting it in March 2022.

Expectations are growing that the Federal Reserve will raise interest rates by the most since 2005 this year.

Source: CME Group

How much depends on who you ask: Goldman Sachs is anticipating nine rate hikes, while traders are betting on at least six.

As we move forward, the Fed will be forced to weigh the effects of inflation readings at 40-year high versus the prospects of tightening into a potentially slowing economy, all while keeping an eye on asset prices.

Non Transitory Inflation

In addition to rising interest rates, persistent inflation is another cause of concern. Following a deflationary period in 2020, inflation began to rise in 2021 and is still rising by hitting new records, reaching 7.5% in January, the highest level in 40 years.

For much of 2021, global central bankers argued that price pressures were ‘transitory.’ However, with commodity prices remaining elevated, inflation has now become ‘persistent.’

As a result, markets have been jittery so far in 2022, as investors grapple with the rising risks of an inflation induced recession and the S&P 500 fell nearly 12% from the all-time highs, but has since recovered roughly one-fifth of its lost value.

In summary, stock market participants may have already started to look past interest rate hikes and quantitative tightening, to worry about inflation.

What the Stock Markets now expects of the Fed

Key executives at the US Federal Reserve finally admitted, after a long time, that they had misinterpreted an inflationary surge that turned out to be deeper and more persistent than they had anticipated.

The challenge now, in front of the FED, is to formalise a policy to counter inflation. The Fed does have the tools it needs to keep the stock markets from experiencing wild swings.

To do so, the first step would be to halt the additional liquidity flow, as the US Fed had significantly infused liquidity during the easing period by pumping in additional funds.

Second, it must accelerate the tapering of its monthly asset purchases.

James Bullard, President of the Federal Reserve Bank, has recently made headlines with his calls for aggressive Fed action. He has advocated for a full percentage point increase in interest rates by July in an effort to tame soaring prices by “front-loading” rate hikes as a way to stay ahead of inflation, which has been running at a 7.5% clip over the past year.

If Fed officials have already sounded front loading rate hikes to the market, the stock market which is a forward looking discounting machine, may already have priced this in.

Such that when the ‘Actual news’ eventually occurs, a plausible scenario may be a market rally!

As the Fed is going to start its rate cycle hike, will the markets rally?

Near-zero interest rates and high liquidity accounted for a large portion of the stock market rally in 2020 and 2021, and it is safe to assume that, as per the conventional wisdom, the markets will react negatively to these rate hikes and liquidity reductions. However, the question is whether the effect will be long-lasting.

One way to understand the probable outcome is to simply examine what happened in the past when the fed hiked interest rates.

Historically, the central bank’s tightening plans have not caused too many market jitters. The S&P 500’s average annual total return was 10.5% from 2004 to 2006 when the Fed hiked rates 17 times in a row, and 9.8% from 2016 to 2018.

Then, why does everyone believe that when the Fed raises interest rates, the stock market will crash? Well, it is intuitive and common sense that if money, which is the market’s fuel, is taken away, the markets will stumble.

Now there are always other forces at work, rather than a simple rule of thumbs.

Typically, the Fed raises interest rates in response to stronger economic growth (a symptom of which could be higher inflation). When the economy is performing well, corporate profit grows. When corporate profit grows, stock prices rise. Stocks are unconcerned about our own conventional wisdom. They simply respond to profits or increases in profits.

Conclusion

Since the beginning of the year, market volatility has increased due to growing uncertainty about upcoming monetary policy, and markets may therefore continue to struggle in the near future.

However, as we have witnessed in history, stocks tend to perform just fine when policymakers move ahead on tightening the cycle of monetary policy.

Therefore, our community readers should start to focus on the ‘Fed combating inflation’ rather than simply focusing on reduced liquidity, a result of tapering or rate hikes, which, according to conventional wisdom, is typically interpreted negatively for the stock markets.

Please note that all the information contained in this article is intended for illustration and educational purposes only. It does not constitute any financial advice/recommendation to buy/sell any investment products or services.